The idea of becoming independent is both exciting and terrifying when you’re first starting out. Depending on your situation, your independence might seem further from reach than it may be for others and it might also be more or less necessary.

If you’re in a household that’s less than ideal, or perhaps you’re no longer welcome at home once you turn 18, figuring out how to get by on your own is something that’s better sorted sooner rather than later.

It’s tough though. Moving out of home as a young adult has become increasingly unpopular in recent years. Over 50 per cent of young adults in Australia live with one or both parents according to the HILDA Survey findings released in 2019. Experts suggest this is due to many socio-economic factors including an increase in housing and living expenses.

Try not to panic though, because there IS help out there. There are ways to get on your feet, get by and hopefully get to a point where you can be stable on your own.

There are a few tips and tricks I’ve learned over the last couple of years that helped me get to a point where at the raw age of 21 I’m in a relatively financially and emotionally stable position and I now know where all the great resources available to me are if ever there’s an emergency or need for them.

While the whole “raised a Jehovah’s Witness” experience is one quite like no other and those of us brought up in this unique, isolated and distorted little world share many common experiences, feelings and struggles, everyone’s situation varies and we all have different reasons for needing to stand on our own feet to gain the freedom that lets us live our lives authentically or at the very least, live without feeling an obligation to be in servitude in some way to the people on whom we used to depend.

Former Jehovah’s Witness Sam, 26, from the United States has lived independently from her Jehovah’s Witness family since November of 2019 and has overcome many challenges to achieve independence and stability. She told me:

I have always wanted to be independent from a very young age and it was harder for me than the average person I think, because I have a disability which makes certain things harder but I still didn’t let it stop me. I felt the only way for me to really get out from the way I was raised was to push myself out of my comfort zone and I didn’t want to live my life for other people anymore as I did that for most of my life, I just got fed up. I thought ‘okay now it’s time to live my life the way I want to’ and the first step of that was to find my own place and become independent.”

Sam

Although we live on opposite sides of the world and have many differences, I found many of the thoughts and feelings Sam experienced personally very relatable.

Just a few years ago, at 16, I can recall laying in my bedroom feeling somewhat trapped and feeling like my 18th birthday was forever away.

For some reason, I imagined my 18th birthday as being a day where I sort of ‘miraculously’ became adult, could walk right out of the house and slip with ease into being a completely independent person who just had fun all the time and didn’t have to follow rules.

Unfortunately, that’s not really how it works. In reality, there is A LOT of fine print that comes with ‘freedom’.

But backing up a little, to be fair I wasn’t really trapped. By 16 I had a boyfriend, my parents had basically given up on the idea of me being a “good” daughter and I could pretty much do most normal teenage things as long as it was out of sight out of mind for my Jehovah’s Witness family.

Nevertheless, that trapped feeling was still very present because I felt judged. I didn’t have much real space and I felt like I could never be my true self.

I had to compartmentalise everything and live that double-life. I had to lie, or choose to not disclose information, and I didn’t really have any trustworthy older person I could turn to to discuss real problems I faced, which didn’t feel great.

I craved that feeling of just being free, and by free I mean not feeling guilty or like I had to conform to some sort of idealistic way of behaving for my family and their JW friends purely because my existence (or at least quality of life) depended on them.

After finishing high school I moved into my uncle’s house which was much closer to the city. At that point I was 17, about to start studying at university (I was allowed to do that) and still very much dependent on family for living expenses.

Plans changed quickly though, because I ended up falling pregnant within a few months (which, as you can imagine, caused quite a stir).

If there wasn’t an urgency to become independent before, there certainly was now.

To cut a long story short, I chose to keep the pregnancy and thus was on a mission to get my s*** completely together within nine months.

This meant I had to: get a job (with no previous experience other than, uhhh… newspaper delivering and baby-sitting?), get a driver’s license, sort out housing, mentally prepare myself for a baby, physically prepare a home for a baby and pretty much re-evaluate my entire future.

So, did I do all that? Yep. How did I do it? I don’t remember exactly how but there was a level of determination, a level of unavoidable anxiety that drove me into hyper-focus mode, there was some help from others and then of course there was a certain amount of just luck.

I acknowledge two of those things require some privilege that not everyone is fortunate enough to have but hopefully this article can hopefully still offer some insightful, helpful and practical advice on how to build and maintain an independent life.

There are five important steps that come to mind when reflecting on my personal experience with developing self-sufficiency. Some steps include great detail which I realise might seem overwhelming if you’re only just exploring your options, so keep in mind it’s all a process and it takes time.

Anyway, let’s get into it.

Step 1. Lining up ducks and getting employed.

If you’ve read Lloyd Evans’ How to Escape from the Jehovah’s Witnesses then you know in Chapter three “Planning your exit” he suggests getting your ducks in a row before leaving your Jehovah’s Witness life behind or potentially burning bridges with family members you currently depend on to like… you know…. live. This advice is quite essential if you’re in a position where you have strong ties to the Jehovah’s Witness religion that you wish to distance yourself from.

If you haven’t read the book, I recommend reading it as it’s extremely relevant. Perhaps buy it in kindle form so you’re at lower risk of family finding the book and placing you in an awkward, potentially damning position. It’s available for purchase here.

“You might really want to become independent, maybe even right now, but you should have a goal to learn certain things before you’re out on your own so that you don’t have to learn it on the fly. Have a plan; in fact a plan A and a plan B.

Make sure you’re in a financial place to do it; don’t just do it because everyone else is doing it because then in the long run you might be worse off,” Sam explained.

Stephen, 22, from New York has been saving up and working towards moving out of his JW family home for quite some time and plans to do so in three months. He told me:

I currently have a decent amount of money to live alone now but I want to save up more before I make the move. I’ve already talked with a co-worker of mine and he’s happy to rent me a room for a super low rate so that by the time I move I’ll have a lot of money saved and I can literally still save money while paying rent when I move in. So, I have a great deal in place.”

Stephen

So, start with money. If you already have a job, that’s great. If it’s casual or part-time you might consider asking your boss for more shifts and start a savings account where you can put away as much cash as you can for a potentially rainy day (maybe a car, or a bond/deposit for a rental when you finally move out).

If you don’t have a job yet, then it may be time to start researching on seek, linked-in or other employment websites and work on your resume. Here’s a website that can help with that. You’ll also need to get a tax file number.

You should checkout your local grocery stores, restaurants and retail outlets for any job openings. Perhaps something casual or part-time if you’re still at school, TAFE, college or university.

In my situation, I was fortunate enough to get employed within a week of finding out I was soon to be a teen mum. It was a casual, telemarketing job with only two shifts a week to start off with but still, it was something.

I grabbed onto that opportunity with both hands and worked my way up to becoming a valued member of the workplace who, with time, gained a bit more flexibility and shift opportunity.

I actually still work there now, over four years on because I love it there. It gives me security and I always feel welcome. Having a job you feel you can always fall back on is something you should hold on to and value because not everyone’s that lucky.

It’s also great on your resume if you can show you’re a loyal employee who’s in it for the long haul. Many successful business people including Business Journalist, Author and Chairman of the board at Quadio Media, Suzy Welch, suggest staying at one workplace for a long time is far more attractive to potential employers than a resume full of short-term employment at several different businesses.

A driver’s license is also something you should consider getting (if you haven’t already) while you’re still in the process of becoming independent. It can be expensive to get lessons and pay for your test so throwing some money into that while you’re still at home may be a good investment in the long run.

According to Flourish Australia, having a driver’s license increases employment opportunities too.

While you’ve got some time on your hands, explore getting some extra qualifications to improve your chances of both getting work and eventually getting a better paid job.

Katy Sykes, 29 from the UK was raised a Jehovah’s Witness and was tragically a victim of child abuse in her family home. Katy says she endured many challenges throughout her young adult life including homelessness at times and addiction issues. She has lived independently for 11 years and says being prepared with certain skills and abilities could make your transition much easier.

Preferably make sure you’ve got ways to support yourself like a job or you are in higher education or something that’s going to help support you further on down the line, that’s key. There’s so many people I’ve met like myself who have left whether it was through our own choices or we were pushed out and we just didn’t have any network or didn’t have any support, didn’t have any job or higher education or anything like that and have spent years and years trying to get back on our feet again so make sure you’ve got that network already set up.”

Katy Sykes

If you’ve been raised as a Jehovah’s Witness, unfortunately the odds are stacked up against you in regards to higher education. According to Pew research, 63 per cent of Jehovah’s Witness adults in America have no qualifications past high school. In 2014, research showed only nine per cent of Jehovah’s Witnesses in America held a bachelor’s degree.

But there is good news. While you may have grown up being discouraged from seeking out tertiary education and may have listened to countless talks about the ‘dangers’ of it, you have the power to make your own choices, do your own research and re-write your own story.

If you find yourself either studying or wanting to study, consider applying for youth allowance. Alternatively, look around for other payments and forms of support for students and young people available in your region.

Step 2. Find a practical place

When you start looking for a place to move into, consider what surrounds it.

Ask yourself questions like;

Are you close to public transport? Can you access important goods and services easily? Are you near a large shopping centre? Internet cafes? Do you have a support person such as friend or family member in the area?

It’s important to have as much access to these facilities as possible in case of emergencies or less than ideal scenarios, i.e. not having much fuel, your car not working, not having a car, losing internet access, running out of money or a multitude of other inconveniences that will likely occur at some point.

Often the most convenient places to live are closer to the city, which sucks because closer to the city usually means more expensive. Your next best is finding a suburb that is well-established with shops, transport and government services.

When I was looking for my first rental I didn’t have a driver’s license yet so I found an affordable place that was about 500 metres away from a train station which I could walk to everyday to travel to work and university.

My place was also walking distance from a shopping centre, police station, Centrelink, social service centres, a library, a bulk-billing doctor’s surgery and lots of cafes with free wifi which gave me a sense of security knowing I could always access help even if I didn’t have money or a car.

When choosing your first place to rent, depending on your financial situation you might want to look into just getting a room in a share house to start off with to see how you go with affording all other living expenses on top of rent.

This can help remove a lot of the anxiety with having to buy a full house worth of furniture and appliances because usually established share houses are already set up with furnishings and appliances.

This experience may not be ideal, but you could use the time to learn how to manage money, figure out what you can actually afford week to week, and perhaps save for those extras for once you finally do get your own place.

When looking for your own rental, figure out what you can realistically afford to pay weekly in rent and then set that as your maximum in the search bar filters on realestate.com or Zillow (or whatever site you use) and DON’T look at anything above that! There’s no use groveling over what you can’t afford. Just look at what you can and be proud of that.

If you happen to be an Australian citizen, consider applying for rent assistance at Centrelink as soon as you move into your own place or a share house. You’re likely eligible and if it turns out you’re not, there’s no harm in applying anyway. Every little bit helps.

Step 3. DO. YOUR. RESEARCH.

A decade or so ago, access to internet might have been considered a want over a need but today it’s extremely essential. Make wifi a priority when working on your budget because the internet is where you can access all of your resources quickly.

Knowledge is power. The internet helps you attain knowledge and therefore the internet is key to your survival. As mentioned above, if you can’t afford your own wifi at least make sure you can access it daily at a place that’s convenient.

Do extensive research into what services you can access. You might be surprised at just how much help there is out there when you look for it and, most importantly, there’s no shame in taking full advantage of every available service designed to assist you.

The resources and terms I refer to in this article (e.g “medicare”, “my.gov”and “Centrelink”) are mostly Australian (as I’m from Australia) so if you happen to be in another country, consider looking for the equivalent or similar services in your local area if needed.

Set up a gmail account. This is your adult email. Don’t let spam into it, just use it for the important stuff. One of the first things you should do as a new adult is create a my.gov account (or similar in your country) and link in services such as the ATO, Medicare and Centrelink. Sort out getting your own health care/medicare card, customer reference numbers (social security) and superannuation account and connect them to your personal bank account so it’s all under your name. This way only you can access your information as well as receive your medical and tax rebates.

While you can, Google important numbers for the services you need access to all the time, such as your electricity, gas and water supply companies, and save these numbers in your phone as contacts in case you lose internet access and need to contact them urgently.

Step 4. Budgeting- How to be a tight a**

So this is where it gets complicated but trust me, if you pay attention and get it all set-up your money managing will eventually go on auto-pilot and you’ll thank me later!

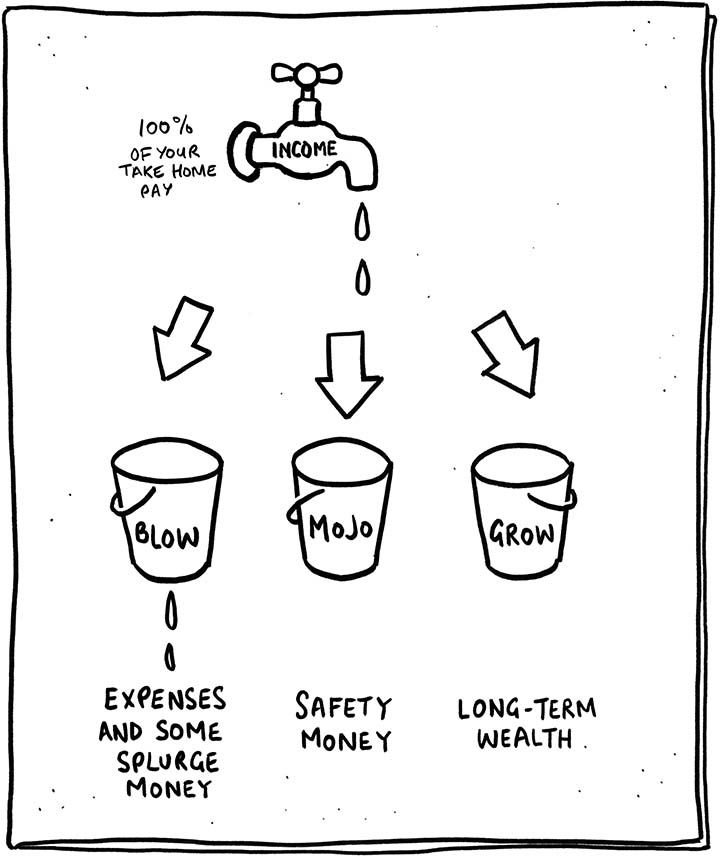

When I was getting ready to move into my first rental with my boyfriend, my uncle was reading this book called “The barefoot investor” by Scott Pape and he let me have a read. I think the target audience was more for the successful entrepreneur type who was looking to become an investor and less for soon-to-be teen mums working out how to get by on almost nothing, but there were still some tips in there I found to be useful in managing money for the first time.

The book includes a strategy of separating your money into a few different bank accounts in terms of percentage. Pape says your everyday expenses (bills, food, fuel etc.) should take up about 60 per cent of your pay, 20 per cent should be your safety money, 10 per cent splurge and 10 per cent ‘smile’ (savings).

You can alter this to your specific needs but try keep to the percentages when establishing what your budget should be.

First things first: you should have just one pay-in account where all of your income gets paid into.

Then if you can, consider setting up four seperate accounts where you divide your money up into each pay, some accounts should have no card access.

–Everyday– with card access

–Emergency-with card access

–Savings– no card access

–Bills– no card access

–Splurge with card access (you can use your pay-in account as this with whatever is left over after transferring out your essentials and savings)

The first thing I do on pay day is pay rent so it’s out of my mind and I know I’ve got a roof over my head this week.

Then I look at what’s left and divide it.

Let’s start with the unavoidable bills you will have to constantly cough up cash for when you’re out there on your own.

-Rent

-Electricity

-Wifi

-Phone plan/credit

-Water

-Gas

-Food

-Fuel

-Car registration

-Your license fees

-Car insurance

OR

-Public transport

I think that’s about it, but that’s just to survive out here… it’s rough. But here’s the thing: we can manage.

Those quarterly utility bills can be killers when they turn up. One of the first things I did when I moved out was make it so they weren’t quarterly. Most utility services will give you the option of spreading out your payments over the year with regular direct debits.

For example, instead of waiting for a $300 power bill to arrive in the mail every three months, which I would need to pay in full, I pay Synergy about $50 per fortnight/$25 per week which is automatically deducted from my ‘bills’ account. I do the same with Alinta for gas. This makes life way more manageable and sometimes I even end up in credit with those utility companies and don’t have to pay anything for a while.

You can apply the same strategy to your phone plan, wifi and insurance.

Try to arrange for them to all come out on the same day per fortnight or week from your ‘bills’ account so you know when it’s coming and you can have the money set aside in that account ready.

Have an ‘emergency’ account set up where over the first few months of earning money you try to get about $1000 in there that you never touch unless it’s an emergency. This is your safety net if something unprecedented happens which requires immediate fork out of cash, i.e. you have to pay for an ambulance bill, your washing machine breaks, your fridge dies or something goes wrong with your car.

Then you have your account with a card attached to use for your everyday essential stuff like buying fuel, a train/bus ticket and grocery shopping. Remember, you should already have a set budget for how much you can spend on those things so the card should just have that amount on it.

To stick with your everyday expenses budget, meal planning is very important. Before doing a grocery shop sit down and plan what you will have for each meal for the next week. Try to set a limit for the total cost of each meal. For example, I set a $10 limit for each dinner I cook for my family.

At first, I cooked A LOT of spaghetti. But this is where you can research and get creative, there are plenty of sites you can use to discover recipes that are affordable.

I often find if I’m cooking something cheap like sausage curry or spaghetti, I buy the ingredients in bulk and cook up a big batch so I can freeze some and have left overs for the next day. This saves a lot of money, food anxiety and time.

Take some time to get to know your local stores and where you can get the most affordable products from. This might be a headache at times to go to different stores, but I go to three different stores for various products to help save money.

For instance, the Spud Shed is where I go to get my fruit and veg because it’s significantly cheaper there than your other grocery stores. I go to ALDI for non- perishables and snacks in the cupboard because they have the best deals for those and then I go to COLES or Woolworths for my meat and dairy. I’ve found this process saves a huge amount of cash which I often can then add to my splurge or savings!

I also want to mention that rewards cards and coupons are your friends! Every time a cashier at any store asks if you want to become a store member or have a rewards card, just say “yes.” Especially at the regular stores you visit, you will find at times you’ll get a discount, deal or freebie that really helps out. My Everyday rewards card is my favorite because every now and then I get $10 off my food shop which is a nice surprise. Concession/pension/ health care cards should be with you at ALL times (if you have one) because you can pretty much use it to get a discount on anything whether it’s medication, a train ticket, fuel, food shop, restaurant or even an event.

Anyway, your splurge account is your fun account. Set aside a small amount of leftover cash (if you’re lucky enough to have some) to use for a dinner out, coffee with friends, new clothes or the movies. Once it’s run out then that’s it until your next payday!

Your savings is the account you don’t touch until you’ve reached your goal. Set aside an amount each payday to send straight to savings, which is what you will eventually use to level-up, whether it be a TV, car, holiday, house or a cool clothing piece, it should be something you’re really looking forward to.

Also, please please avoid credit cards at all costs especially when you’re starting out. It’s a slippery slope and, while it’s tempting, I promise you you’ll likely amass debt and end up worse off for a long time.

This system might seem hard-core but on a relatively low income my fiancé and I actually managed to save $8000 in just 11 months of living independently which we used on a dream holiday when my son was one and we were 19.

So, while you may not be traveling anytime soon and budgets vary, I promise it can work if you commit.

However, this is just one way of managing your money and you may find a different system that works for you. Everyone is different so another method could be what’s best in your situation. What’s most important is finding something that works and keeps you stable both now and into the future.

Sam says one of the biggest challenges for her when she first moved out was budgeting and money management. At first she was excited about having her own money and was tempted to ‘blow it all at once’ but she said that can land you in a position where you don’t have any money left in case of an emergency.

I grew up with no life skills so a major thing for me was budgeting. I didn’t know how much the things in the real world cost because I never had to deal with it until I moved out on my own. I started to learn by trial and error and now I have a system where I write everything I spend down in a book so I keep track of my finances and it seems to work better that way and makes me more conscious of what I’m spending. I think everyone can always get better with budgeting even if you think you have it down there’s always room for improvement.”

Sam

Budgeting is tough. It requires time, organizational skills, and it also takes a great deal of self-control. But you can do it!

Step 5. Get your head right

When you move out of home you can get lonely. You learn a hell of a lot more about yourself and there may be a lot of unprocessed feelings as a result of your up-bringing or potential fall-out from leaving your family home and becoming your true self.

Now that you have the space you need, it might be time to seek out some professional help to gather your thoughts and process some of those emotions.

Even if you have no past traumas, religious issues or existing mental illnesses, the stress alone from being an adult can be a burden when you first start out so I highly recommend seeking out some therapy.

Therapy can be expensive, but in many countries there is help and resources available to young people in particular, making therapy more accessible. If you’re between 12 and 25 years old and an Australian citizen I recommend visiting a headspace near you. Here you can access 10 free counseling sessions per year so long as you can provide a valid medicare card.

After you’ve used up your 10 sessions at headspace you can visit your local GP and ask for a Mental health care plan (MHCP) with which you can access up to 20 extra sessions (currently) annually covering up to an amount of $128.40 per session. So you could potentially have access to 30 free/subsidized sessions of counseling per year if you’re a young person. If you’re over 25 you will still be able to access at least 20 subsidized sessions, which is great. I take full advantage of these resources each year and trust me, it’s really worthwhile. I don’t know where my head would be at today without professional help.

Again, for those living in other countries, it’s worthwhile looking into what affordable counseling resources are available to young people in your region. Even if your country doesn’t offer any subsidy for counseling, consider the prospect of really investing some time and money into your state of mind as it might save you a lot of trouble in the future.

Community and peer support is also essential to your mental health and can be a secondary source of therapy in the sense that having people to relate to, share your story with and validate your feelings (and vice versa) can be a great way to assist you in your healing process. As Katy told me:

You need a strong community, one of the things you tend to lose when you’re in a situation like I was in is you lose that community you’re brought up with and once you’ve lost that you need to as quickly as possible build a strong community again whether that be a community face to face with people around you or online. I would suggest anyone whose about to go through this situation go online, look at Facebook, look at the different forums and try to find a community there or even if you need it Recovering from Religion because they can help you build a good community.”

Katy Sykes

Recovering from Religion (RFR) was founded by Organizational Psychologist and Author Dr Darrel Ray in 2009 and provides peer support and resources for those who are having religious doubts, leaving religion or dealing with other religion-related problems.

Recovering from Religion has hundreds of volunteers residing in various parts of the world. RFR Sydney Support group leader and recently appointed RFR Board member Sherrie D’Sousa says the organization provides in-depth training to volunteers in order to provide high quality, empathetic peer support to those who need it. She told me:

Recovering from religion is an organisation in the United States that started about 11 years ago to help people deal with the trauma of having left high control religious organisations because it is quite a traumatic process to leave. So RFR began to offer peer support and that peer support is either via calling their help line or perhaps reaching out via their online chat or by their support groups.

Sherrie D’Souza

In 2020, Sherrie was involved in building the first Recovering from Religion support group in Australia.

As a result of having left Jehovah’s Witnesses and appreciating how much support is necessary, I was keen to bring Recovering from Religion to Australia and so earlier this year we started the very first support group under Recovering from Religion’s banner in Sydney and I’ve been very much enjoying that. Fantastic, I love the group they really are amazing people and they are all volunteers. No one is drawing a salary, no one is drawing a wage at all they are just very genuine hearted people.”

Sherrie D’Souza

So, seek out therapy, find peer support and try to build a community. There are plenty of online places that can cater to your specific needs so please, do some research and reach out!

While it’s evident that there is a lot of responsibility and planning involved in adulting, it gets easier with time and it’s all a learning process.

Sam, from the United States says it’s important to try your best to keep things simple and celebrate the small wins.

Don’t overwhelm yourself with lots of new changes at once, take it one step at a time. Celebrate the small accomplishments that you might think aren’t a big deal to other people or if people don’t give you credit for them that doesn’t mean they’re not big to you. Like learning how to write your first rent cheque might not seem like that big of a deal, but to me that was one of the first things I did and I thought ‘oh I have an apartment for the next month guaranteed’ and it was a big deal for me.

Sam

Stephen, from New York says he anticipates some opposition from his JW family when he finally moves out and has space to distance himself from the Jehovah’s Witness religion as he identifies as PIMO (physically in, mentally out) regarding his status of belief. He says for those in a similar situation, it’s important to be patient and work towards personal goals. As he explained:

My advice is simple, once you wake up and become a PIMO unless you have it already made, start planning big time. Make short term plans and goals to hit, then expand that out to long term plans and most importantly, have patience. Being patient is a virtue and being humble and sucking it up sometimes when it comes to things you may not agree with as a PIMO is difficult, but important. Keep the end goal in mind and you’ll be able to successfully become independent.”

Stephen

Katy from the United Kingdom insists that while freedom may come at a high cost, it’s always worth it in the end.

“There’s nothing better than freedom in my opinion,” she said.

Paige Lundie | JW Watch Contributor

RESOURCE LIST:

AUSTRALIA

Mental Health and crisis support

Headspace

Lifeline 13 11 14

Suicide call back service 1300 659 467

Crisis support chat

Recovering from Religion +61 3 4505 2402

Beyond blue 1300 224 635

Kids help line 1800 551 800

Blue Knot Foundation 1300 657 380

The Butterfly Foundation 1800 334 673

1800RESPECT 1800 737 732

QLIFE 1800 184 527

SAY IT OUT LOUD

REACHOUT.com

Relationships Australia 1300 364 277

SANE Australia 1800 187 263

Stride Mental Health

Mental Health Australia (02) 6285 3100

Government resources

Services Australia

Payment and Service finder >Help in an Emergency >Youth Allowance >Crisis payment >Low income healthcare card >Coronavirus Supplement >Employment Assistance AskIzzy Managing your money Education and Training

UNITED KINGDOM

Mental Health and crisis support

Recovering from Religion +44 20 3856 8791 NHS >Anxiety UK 03444 775 774

>CALM 0800 58 58 58

>Mind 0300 123 3393

>No Panic 0300 772 9844

>PAPYRUS 0800 068 4141

>Rethink Mental Illness 0300 5000 927 >Samaritans 116 123 >SANE – SANE PEERSUPPORT >NSPCC 0800 1111

>Refuge 0808 2000 247

>Victim Support >FRANK 0300 1236600

>SMART Recovery UK 0330 053 6022

>Beat 0808 801 0677 (adults) or 0808 801 0711 (for under-18s) >Mencap 0808 808 1111

>Relate

>Al-Anon 0800 0086 811

>National Association for Children of Alcoholics 0800 358 3456

Government Services

GOV.UK

Benefits Calculators

>Employment and Support Allowance >Help with Savings on a low income >Help with moving from benefits to work >Jobseeker’s Allowance

>Housing Benefit

>Disability Premiums

>Reduced Earning Allowance

>Work and Health programme

>Help paying bills with Benefits

UNITED STATES

Mental Health and crisis support

Recovering from Religion 1-84-I-Doubt-It

Social Work License MAP

NIMH

>National Suicide Prevention Lifeline 1-800-273-TALK (8255) >CRISIS TEXT LINE Text HOME to 741741 SAMHSA ADAA

Government services

CMS.gov– Medicare & Medicaid services

HHS.gov Mental Health and Addiction Insurance Help HRSA

Terrific article, Paige. I’m sure it will help a lot of folks out there. Your tenacity and discipline are exemplary.

I’m so glad there’s an organization like RFR now. Obviously, there is a need for it. Religion / cultery screws up a lot of people’s heads. Especially, but not limited to, those like us who were raised from a tender age in a mind-control cult. “Get ‘em while they’re young” is one of Watchtower’s cynical mantras, right?

So good you included a section on mental health. Organizational skills are great, but without the right mindset, the best intentions can fall flat. Where the mind goes, the body follows. A healthy psyche and a positive outlook are essential. You CAN do it. You can do anything. And sometimes success is just a matter of hanging on…..

Thanks so much Sardaukar, I really appreciate your kind comments ❤️ and yes I have learned the credit card lesson the hard way haha.

I’ll conclude on the same note – FREEDOM can be hard won. Not a fair state of affairs. But no realistic person ever said the universe was fair. In the end, though, it’s WORTH IT.

P.S. Good advice regarding credit cards. Avoid at all costs.

Just my opinion, but I think credit cards are a one-way ticket to economic slavery.

it is good see my work gmail sign up

Pingback: How Do I Become Independent? - JW.Support

Great content! Keep up the good work!